The Law of Ukraine dated June 25, 1991, No. 1251-XII “On the Taxation System” has lost its force

Received: 07.07.2025

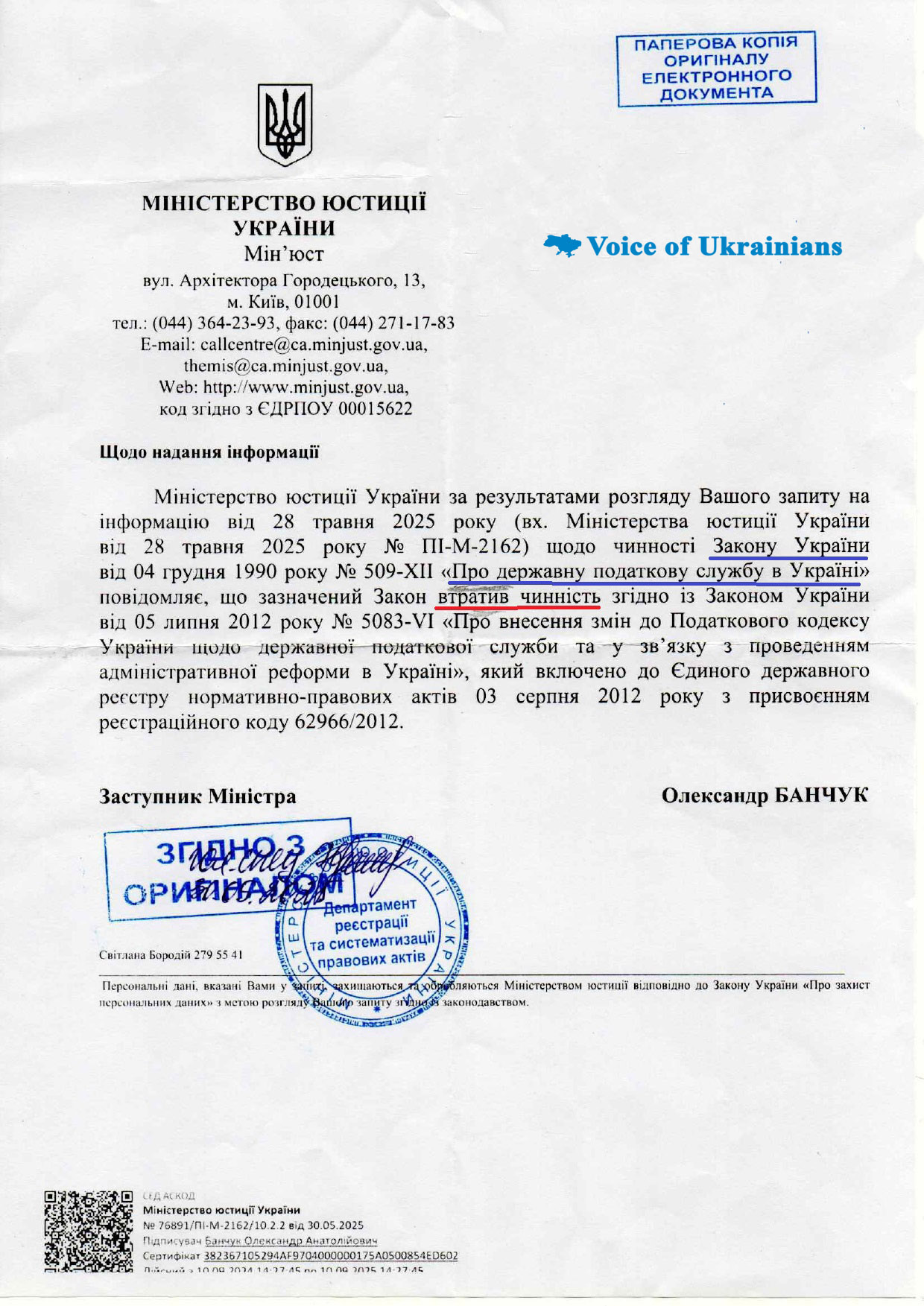

The official response from the Ministry of Justice of Ukraine confirms that the Law of Ukraine “On the State Tax Service” No. 509-XII of December 4, 1990, has been repealed. This occurred as part of the administrative reform codified in the Law of Ukraine “On Amendments to the Tax Code of Ukraine and Certain Legislative Acts of Ukraine on the Improvement of Certain Provisions” No. 5083-VI of July 5, 2012.

The corresponding changes were registered in the Unified State Register of Regulatory Legal Acts on August 3, 2012, under registration code 62966/2012.

However, the repeal of the aforementioned law does not mean the abolition of the tax system itself or the obligation of citizens to pay taxes.

Since January 1, 2011, the Tax Code of Ukraine has been in effect, adopted by the Law of Ukraine “On the Tax Code of Ukraine” No. 2755-VI of December 2, 2010. It has become the main legislative act regulating tax relations in the country.

The tax service has undergone multiple reorganizations. The following is a timeline of these changes:

-

2012: Following the liquidation of the State Tax Administration of Ukraine, the State Tax Service of Ukraine (STS) was established as a central executive authority.

-

December 24, 2012: By Presidential Decree No. 726/2012, the Ministry of Revenues and Duties of Ukraine was created, combining the functions of the tax and customs services.

-

May 27, 2014: By Resolution of the Cabinet of Ministers of Ukraine No. 160, a decision was made to liquidate the Ministry of Revenues and Duties and to establish two separate agencies:

• The State Fiscal Service of Ukraine (SFS) — as the legal successor of the tax and customs services.

-

2019: By Resolution of the Cabinet of Ministers No. 227 of March 6, 2019, a new reorganization began, and the SFS was split into:

• The State Tax Service of Ukraine (STS),

• The State Customs Service of Ukraine (SCS).

-

October 23, 2019: By Government Order No. 1072-r, the STS was granted the authority of the central executive body responsible for tax administration.

Therefore, since 2020, the State Tax Service of Ukraine has been the main body responsible for tax administration in accordance with the provisions of the current Tax Code.

The repeal of the 1990 Law and the liquidation of the corresponding body do not abolish tax obligations. This obligation is explicitly stated in the Tax Code of Ukraine and applies to both individuals and legal entities, regardless of how the tax authority was named in different years. The official repeal of the law merely confirms the end of the Soviet administrative model and the transition to a modern fiscal system.