The Law on the State Tax Service of Ukraine has lost its force

Received: 28.05.2025

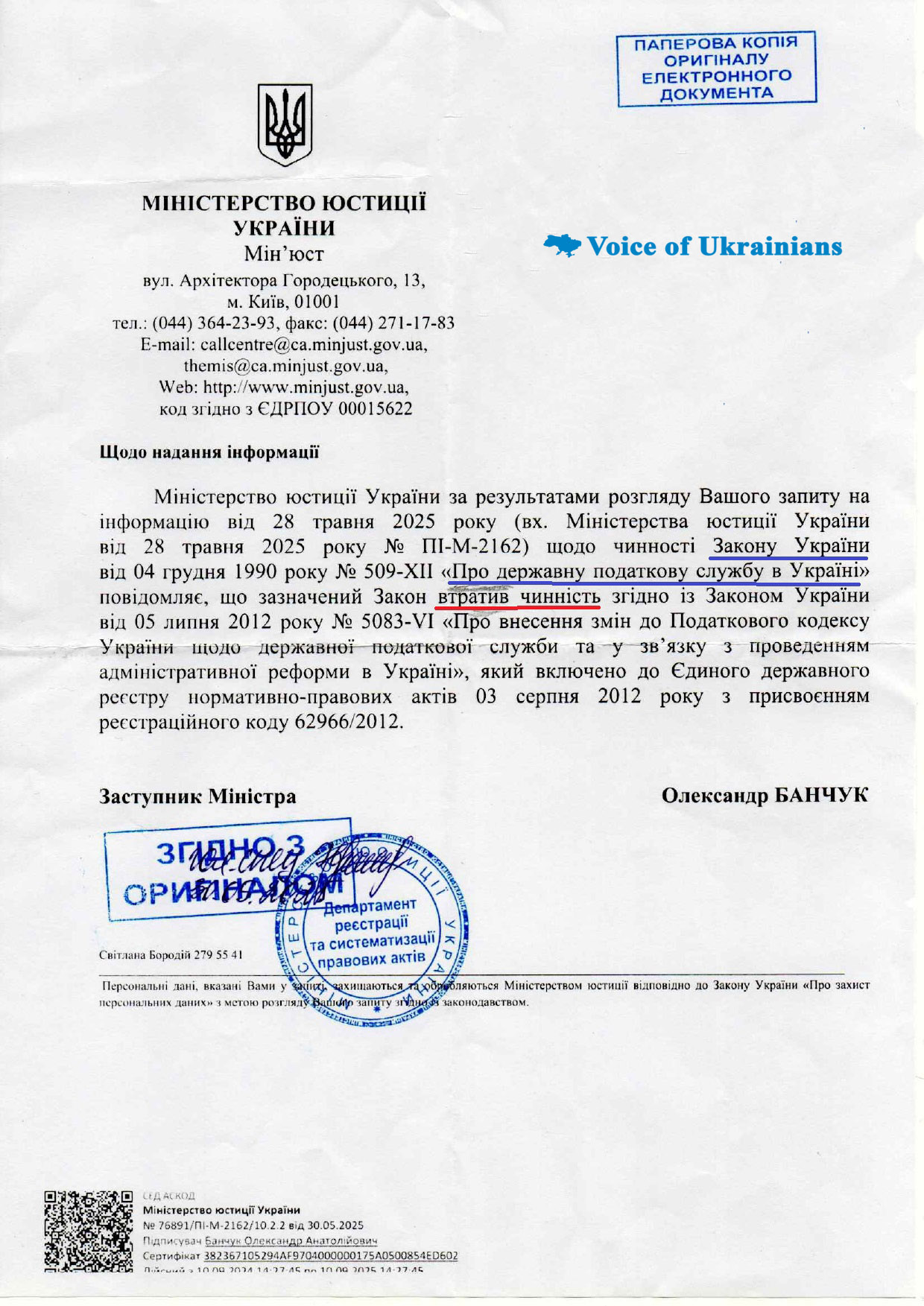

The official response from the Ministry of Justice of Ukraine dated May 30, 2025 (ref. No. PP-M-2162) confirms that the Law of Ukraine “On the State Tax Service” No. 509-XII of December 4, 1990, has lost its legal force. This repeal occurred within the framework of the administrative reform established by the Law of Ukraine “On Amendments to the Tax Code of Ukraine and Certain Legislative Acts of Ukraine on Improving Certain Provisions” No. 5083-VI dated July 5, 2012.

The relevant changes were officially entered into the Unified State Register of Regulatory Legal Acts on August 3, 2012, under registration code 62966/2012.

It is important to understand that the repeal of the 1990 law does not imply the cancellation of the tax system or exemption of citizens from their obligation to pay taxes. Since January 1, 2011, the Tax Code of Ukraine has been in effect, adopted by the Law of Ukraine “On the Tax Code of Ukraine” No. 2755-VI of December 2, 2010, which serves as the main regulatory act governing tax relations in the country.

In addition, the structure of tax authorities has undergone several reorganizations. Below is a brief timeline of institutional changes:

-

In 2012, following the liquidation of the State Tax Administration of Ukraine, the State Tax Service of Ukraine (STS) was established as a central executive authority.

-

On December 24, 2012, by Presidential Decree No. 726/2012, the Ministry of Revenues and Duties of Ukraine was created, combining the functions of the tax and customs services.

-

On May 27, 2014, Cabinet Resolution No. 160 liquidated the Ministry of Revenues and Duties and established the State Fiscal Service of Ukraine (SFSU).

-

-

The State Tax Service of Ukraine (STS),

-

The State Customs Service of Ukraine (SCS).

On March 6, 2019, Cabinet Resolution No. 227 initiated a new reform that split the SFSU into:

-

-

On October 23, 2019, Cabinet Directive No. 1072-r granted the STS full authority as the central executive body responsible for tax administration.

As of 2025, tax administration in Ukraine is carried out under the current Tax Code, and the designated authority is the State Tax Service of Ukraine.

The repealed Law No. 509-XII was part of the post-Soviet transitional legal framework and became obsolete with the adoption of modern fiscal mechanisms. Its repeal is legally justified and does not cancel the tax obligations of individuals and legal entities.